5 Powerful Reasons Leading Brands Choose Ethical Accreditation

Get recognised for doing GOOD. Ethical Accreditation helps values-led brands build trust, attract talent, and stand out where it matters most.

Ethical brand ratings and accreditation since 2001

Get recognised for doing GOOD. Ethical Accreditation helps values-led brands build trust, attract talent, and stand out where it matters most.

Sustainability is driving SME growth. Discover what The Willow Review reveals—and how Ethical Accreditation helps businesses stand out.

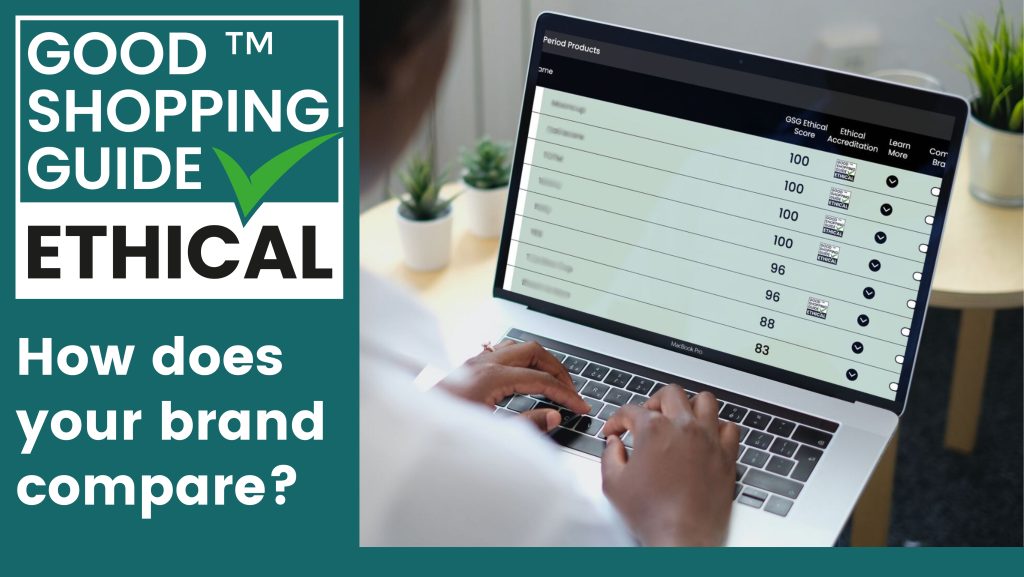

Providing ethical brand ratings across multiple product sectors, making it easy to choose the most sustainable and ethical brands.

Octopus continues to be a certified Ethical Energy Supplier in 2025.

The GOOD Shopping Guide’s ETHICAL mark is a clear signal to consumers of your brand values.

A better way to party, with eco-friendly party and wedding supplier Party Without Plastic.

The GOOD Shopping Guide has been publishing ethical brand comparison scores since 2001.

The GOOD Shopping Guide has supported sustainable alternatives to fast fashion for 25 years.

Gen Z wants transparency, action on sustainability and ethical accountability.

Reaching the ethical benchmark and going beyond in The GOOD Shopping Guide.

Planet Protection earns Ethical Accreditation, exemplifying its commitment to sustainable insurance and paving the way for industry innovation.

The importance of building brand loyalty an trust with a growing market of ethical consumers.