Ethical Banking: the importance of trusted independent verification

Let’s Talk about Ethical Banking!

As consumers increasingly seek out businesses that align with their ethical values, banks and building societies are experiencing mounting pressure to demonstrate a commitment to ethics and sustainability. 74% of UK savers would like their money to have a positive impact on the environment and society. Ethical Accreditation from The Good Shopping Guide allows financial institutions to show they meet high ethical standards. This certification has for 25 years been a trusted signal to customers and investors.

The Ethical Landscape of Banking

The financial industry plays a pivotal role in shaping sustainable development, impacting sectors from energy to housing. However, the transparency of ethical practices within banks and building societies varies. Many consumers are concerned with how their bank uses its funds, whether it supports environmentally or socially harmful industries, and how it treats its employees and customers. Ethical Accreditation provides a comprehensive assessment, allowing consumers to make informed choices without sifting through complex financial reports or policies.

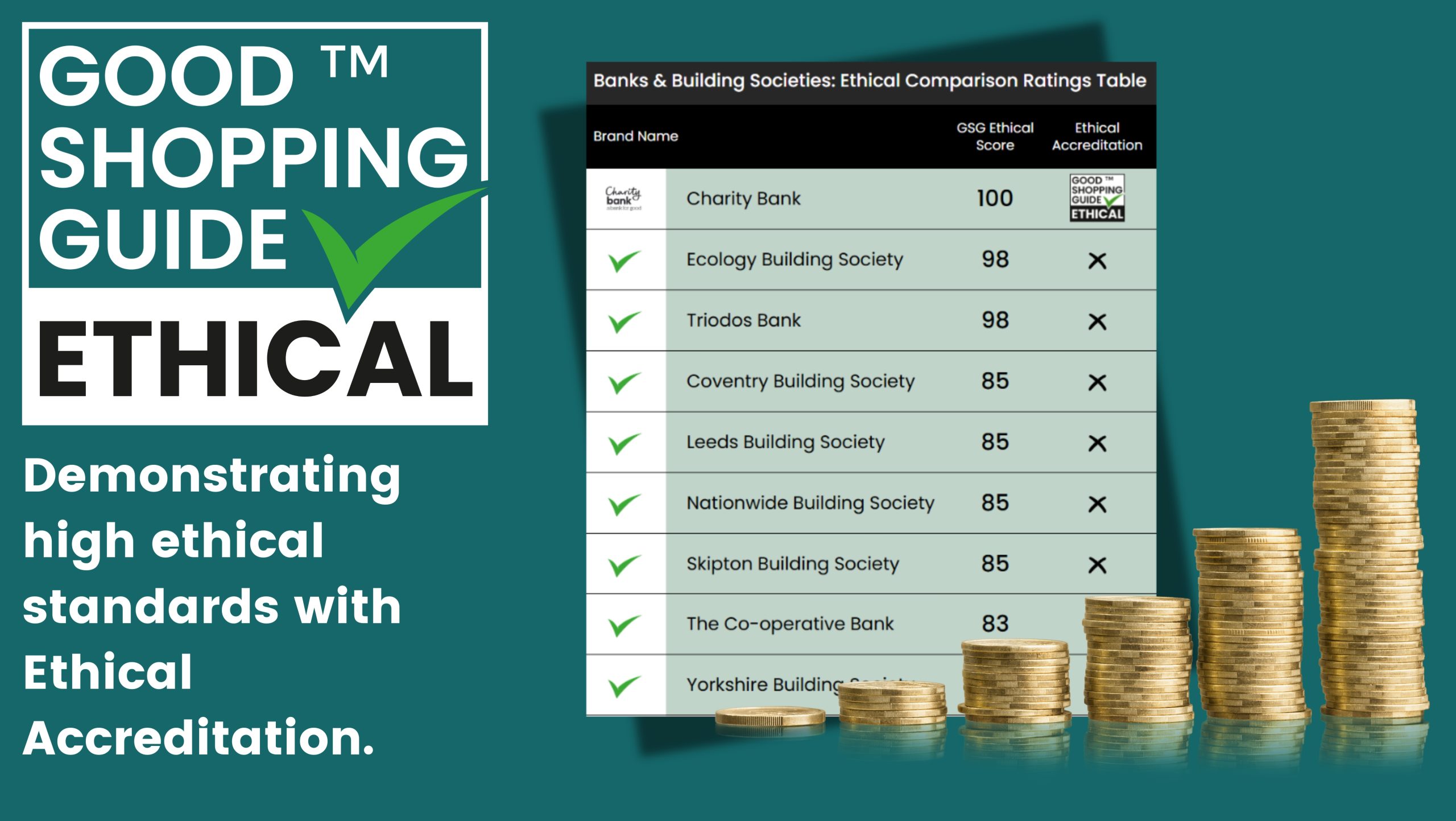

Several progressive banks and building societies prioritise ethical practices. Charity Bank, which has achieved Ethical Accreditation, exclusively supports charities and social enterprises, ensuring that all funds contribute to the greater good. Triodos Bank is known for its commitment to financing only projects that positively impact people and the planet. Ecology Building Society prioritises lending to projects such as eco-friendly homes, sustainable communities, and renewable energy developments.

But there are many others which would benefit from accreditation but have not yet committed to it. As the financial sector evolves, we will see more institutions join the 150 companies like Aviva which are already benefitting from the verification. This helps the millions of consumers who use The Good Shopping Guide distinguish those truly committed to ethical practices. The benefits speak for themselves.

- Enhanced Consumer Trust: Our independent endorsement offers a clear signal to consumers that a bank or building society operates responsibly

- Positive Brand Differentiation: In a crowded marketplace, Ethical Accreditation stands out as a unique selling point, providing verified credibility that disallows greenwashing claims

- Alignment with Regulatory Trends: As financial regulations increasingly emphasise environmental, social, and governance (ESG) criteria, Ethical Accreditation prepares banks to stay ahead of regulatory shifts by ensuring they meet and exceed current ethical standards

If you would like to find out more about getting trusted, independent verification for your brand or company, contact Annabel Wetton.

See our full Banks & Building Societies Ethical Ratings here.

Share

Related articles

How do Consumers find Brands that are GOOD for the Planet?

Independent research helps consumers identify ethical brands they can trust without guesswork or greenwashing concerns.

Which is the Most Ethical & Sustainable Deodorant Brand?

Explore how 28 leading deodorant brands perform on ethics and sustainability, from packaging impact to refillable innovations.

A Bite of Kindness: The Biskery achieves Ethical Accreditation

Discover how The Biskery sets new ethical standards in sustainable, personalised biscuit gifting.